Personal Loan Calculator

As the name suggests, a personal loan EMI calculator is there to help you calculate the EMI amount on your personal loans. With this tool, you can easily plan your finances. It is designed to help you balance the inflow and outflows of money so that you don’t have to go through any kind of financial burden or setback. With this tool, you will never face any kind of issue as far as money management is concerned.

(Principal + Interest)

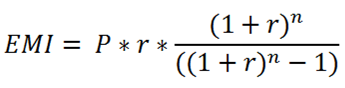

Here's the formula to calculate the Personal Loan EMI:

Where

E is EMI

P is Principal Loan Amount

N Loan tenure in months

R Monthly interest rate

The rate of interest (R) on your loan is calculated per month.

R = Annual Rate of interest/12/100

For example : Let’s say you took a personal loan worth INR 6,00,000 at an interest rate of 15% for 2 years, this is what you will need to pay as EMI.

EMI = ₹6,00,000 * 15/100/12 * (1+15/100/12)24 / (1+15/100/1224 - 1)

= ₹29,092

How to use Personal Loan EMI Calculator?

- Use the slider for selecting the loan amount.

- After that, you will need to select the loan tenure in month format.

- Move the slider for selecting the rate of interest.

- The calculator will show you the EMI payable, Total interest, and Total Payable Amount.

- You can easily recalculate your EMI anytime all you need to do is change the input sliders accordingly.

- EMI will be calculated instantly when you move your sliders.

Benefits of Personal Loan EMI Calculator

A Personal Loan EMI Calculator is a very useful tool that can help you get a clear picture of your financials and fetch you a number of the EMI that you would need to pay on a monthly basis. Plus, it helps you gauge your repayment capacity as well.

Frequently Asked Questions

-

How can this Personal Loan Calculator help me find the best loan for my needs?You can use this tool to compare loans from different banks. All you need to do is enter the borrowed amount, the rate of interest, and the tenure of the loan.

-

What is a secured loan and an unsecured loan?As the name suggests, a secured loan is secured against an asset like a property. On the other hand, an unsecured loan is one where there is no asset offered as security. And a good example of an unsecured loan would be a personal loan.

-

In what time frame can I pay my personal loan?You can repay your personal loan in a period of about 12 to 60 months. However, if you want lower EMIs then you must take the loan for a longer period of time but the longer the tenure the more interest you will have to pay.

-

Can I prepay my personal loan?You can pay your personal loan in full pre-payment method or in partial pre-payment method. For a full prepayment, the entire loan amount can be settled in one single payment.

-

How important is a credit report for the application for a loan?A credit report contains the details of all your previous borrowings from how much outstanding credit you have to how many payments you missed or have made late.